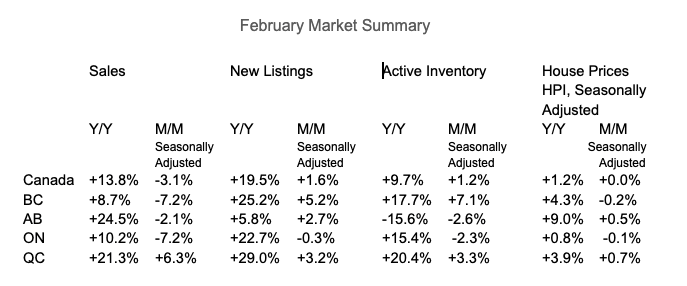

According to an Edge Realty report, in February, provincial real estate markets experienced varied trends, while Canada overall continued to face affordability challenges.

Source: Edge Realty

Home Sales

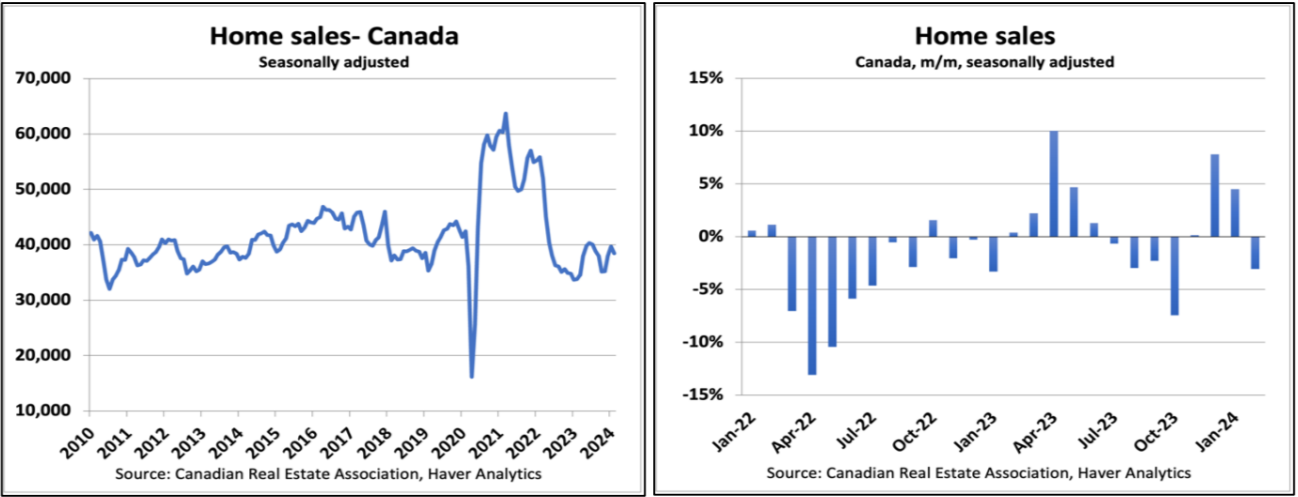

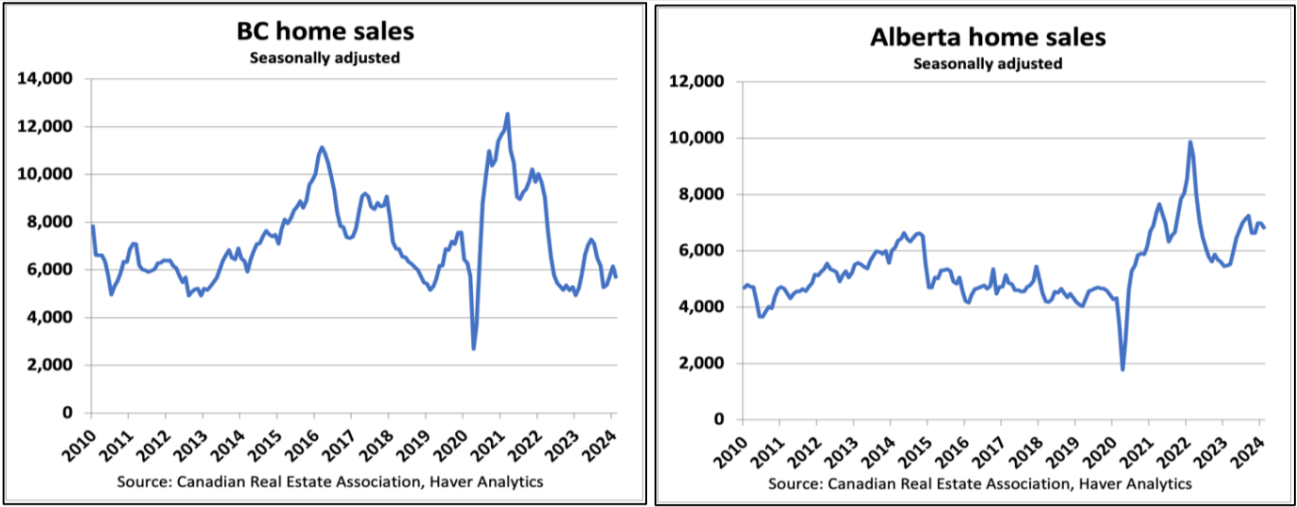

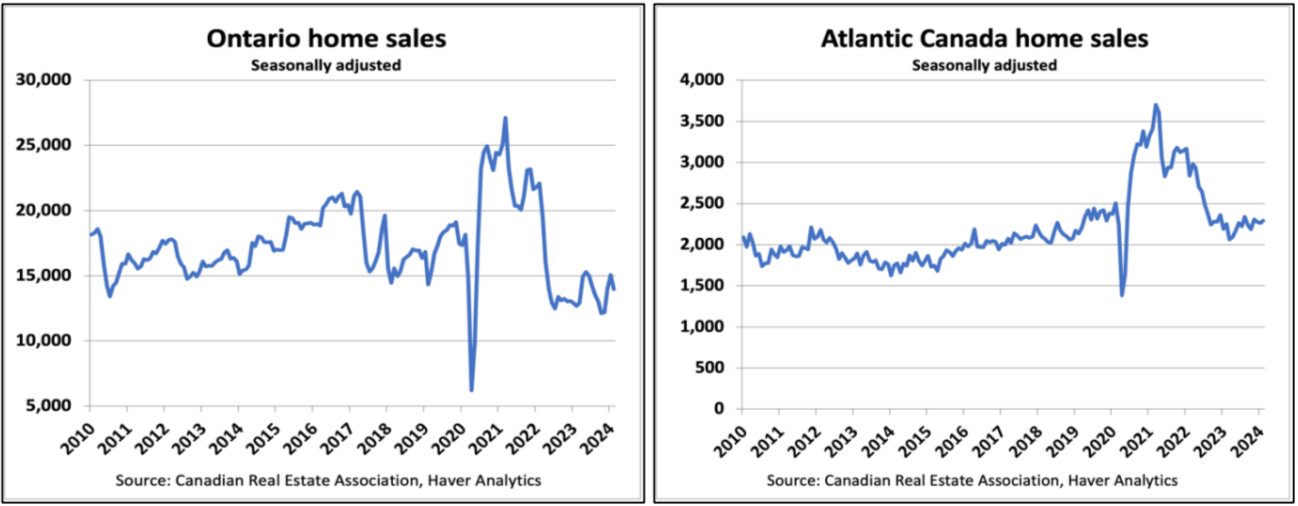

February saw a notable decrease in demand for homes across Canada, with seasonally adjusted home sales for the country overall dropping by 3.1% month-over-month (m/m). However, this decrease wasn’t experienced equally in all provinces, and some actually experienced increases.

The decline was particularly pronounced in British Columbia (BC) and Ontario, both experiencing matching 7.2% monthly declines. However, compared to the previous year, sales surged by nearly 14% year-over-year (y/y), with Alberta leading the charge with a remarkable 25% increase.

Source: Edge Realty

Listings

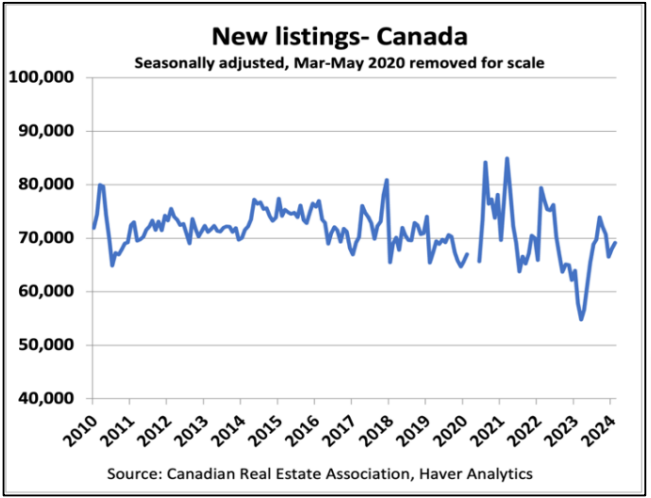

In addition to the fluctuations across the country in demand in February, the supply side experienced significant shifts. Nationally, new listings increased by 1.6% m/m. BC led with the highest increase of a 5% surge, pushing listings to remain 20% above 2023 levels. Again, different provinces had different stories; Ontario experienced the opposite situation with a slight decrease of 0.3% in new listings for the month.

Source: Edge Realty

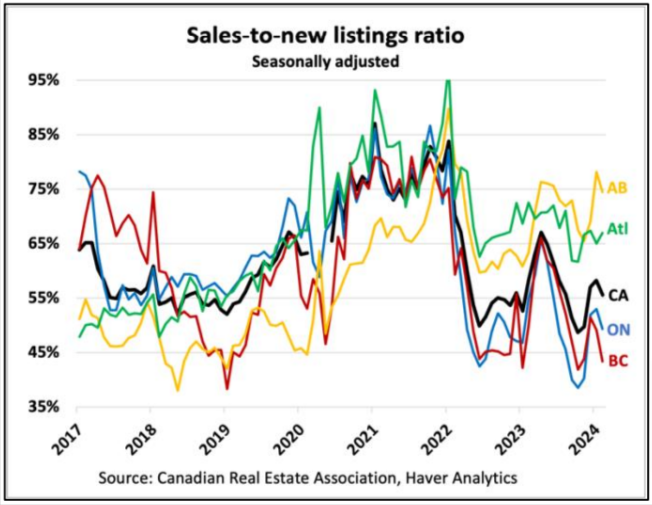

Market balance dropped in February in most regions, with notable declines in the sale-to-new listings ratio in BC, which dropped to 44%, indicating a shift towards a buyer’s market. However, Atlantic Canada bucked the trend, maintaining stability in market balance.

Source: Edge Realty

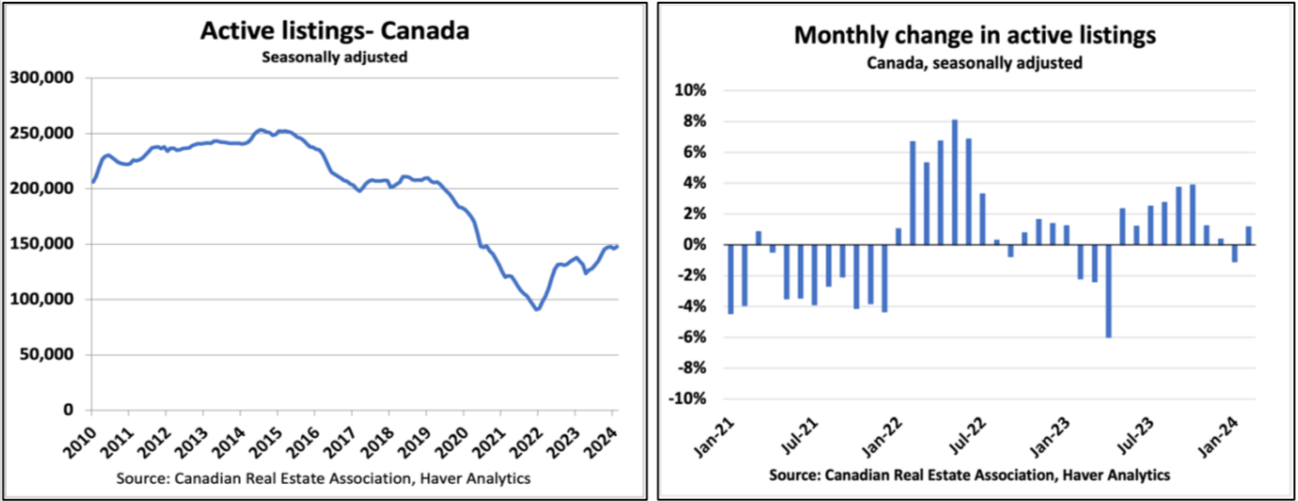

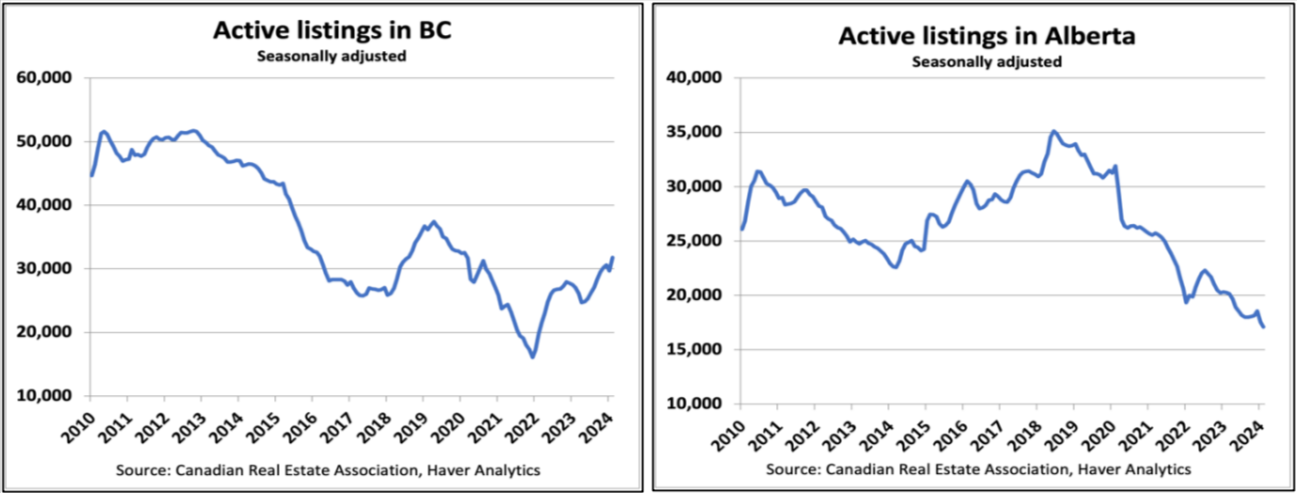

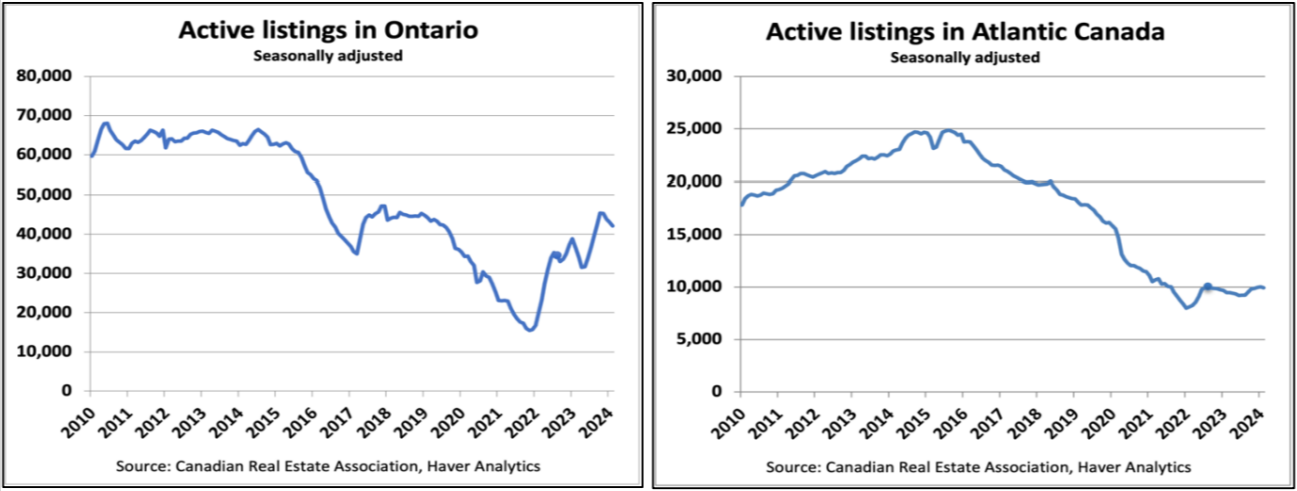

Surprisingly, active inventory at the end of the month rose by 1.2% nationally, for an increase of almost 10% y/y. BC was the main reason for this rise, with a 7.1% jump, while Ontario and Alberta instead experienced declines. Alberta, in particular, saw inventory levels plummet to less than half of what they were in 2018 to 2019.

Source: Edge Realty

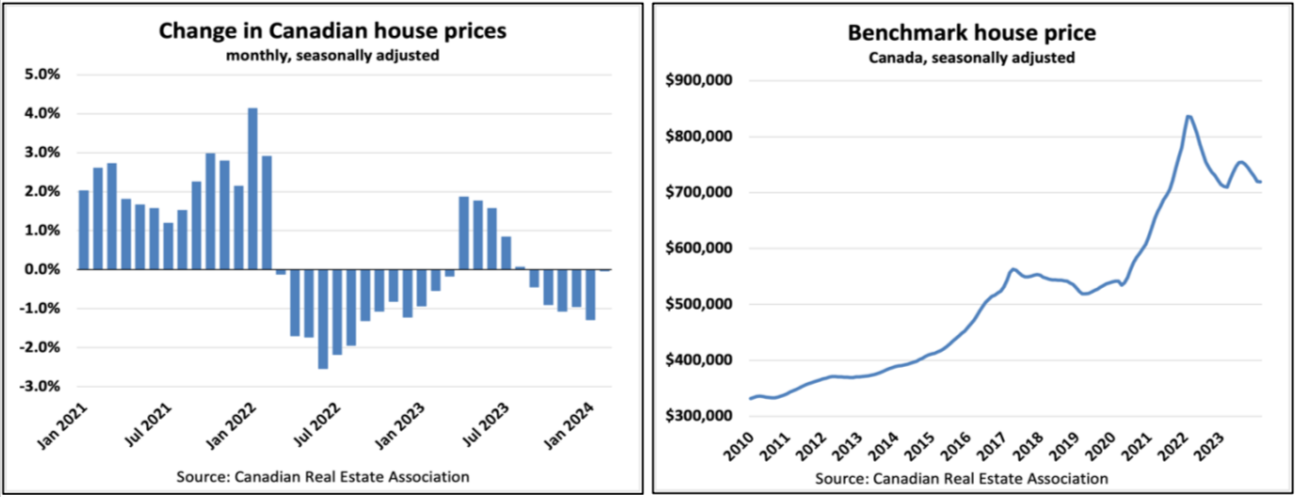

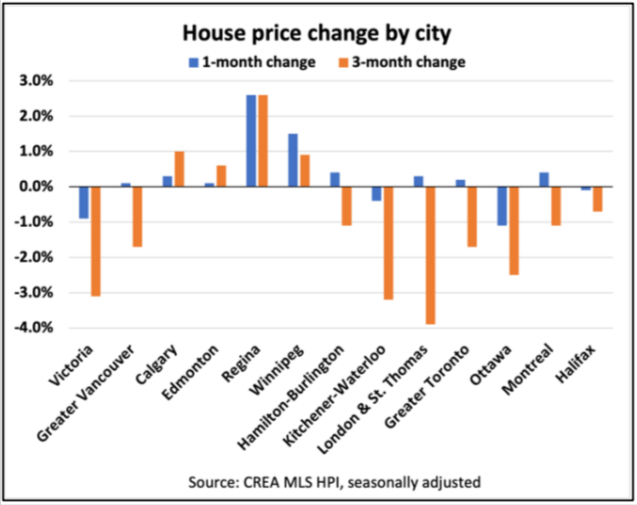

While house prices remained flat nationally according to the MLS House Price Index for February, the prairie provinces continued to see upward momentum. The flattening of the index broke its streak of five consecutive monthly declines. Both the 1-month and 3-month changes highlight the prairies’ positive performance, contrasting with the declines in major Ontario metros.

Source: Edge Realty

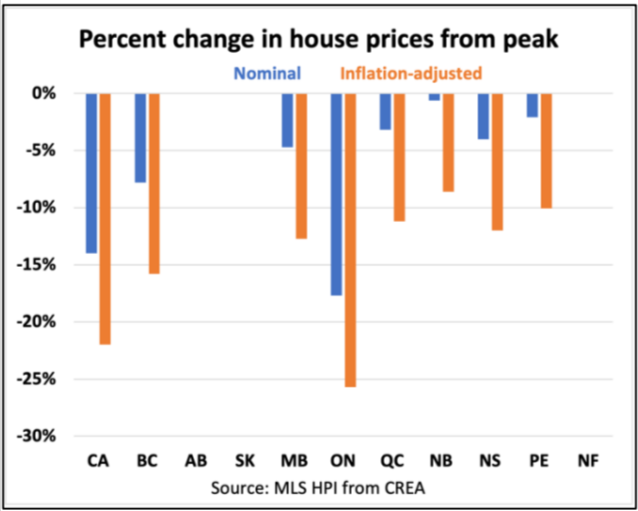

Nationally, house prices in February were still 14% below peak levels, translating to a real, inflation-adjusted, decline of 22%. This emphasizes the significance of this real estate correction in Canadian history, even if it is experienced to different degrees across the different regions.

Source: Edge Realty

Despite the February trends in house prices, the affordability challenge persists. The monthly payment required to buy a typical home in Canada at an 80% loan-to-value ratio decreased to approximately $3,250 in February, down $18 from the previous month and nearly 9% from the peak in September 2023.

However, other than in the prairies and Atlantic Canada, affordability is still a large issue.